Are you ready to take your efforts to the next level? The way to go is with Qualified Opportunity Funds. Investors love these funds because they have a high chance of making a lot of money and offer unique tax breaks. Investing in qualified opportunity funds can change the game for any investor, no matter who they are or how new they are to invest.

Don’t miss out on the chance to make your business more diverse, improve your bottom line, and help people who are less fortunate. You can get in on the action with Qualified Opportunity Funds and learn how to make money. On your journey, knowing the reasons below to invest will help.

10 Reasons to Invest In Qualified Opportunity Funds

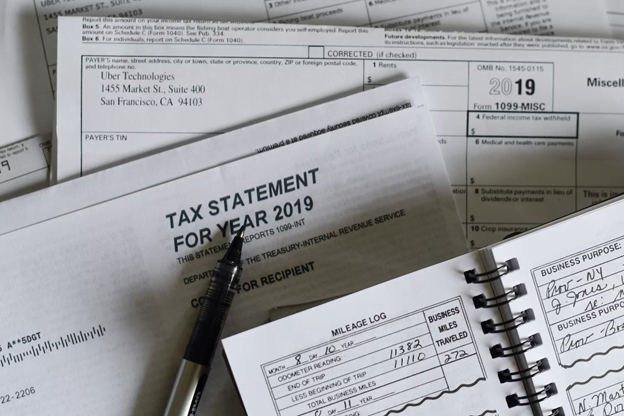

As part of the Tax Cuts and Jobs Act of 2017, the Opportunity Zones program was put into place. As the qualified opportunity zones news reported, the QOFs gave people and organizations a one-of-a-kind chance to invest in economically disadvantaged neighborhoods without paying taxes on capital gains immediately. Qualified Opportunity Funds, also called QOFs, are investment vehicles that give buyers tax breaks for putting money into Qualified Opportunity Zone. If you are thinking about investing in QOFs, here are ten reasons why you should:

1. Tax Deferral

One of the best things about this investment tool is that you can invest in Qualified Opportunity Funds (QOFs), which give you a chance to put off paying capital gains taxes. When buyers put the profits from selling an asset that has gone up in value into a qualified opportunity fund (QOF), they can put off paying taxes on those profits until the stock is sold. Because of this, investors may be able to put off paying a large part of their taxes and keep more of their gains in the stock market, which leads to returns that grow over time.

2. Tax-Free Growth

Profits from the QOF investment’s growth may not have to be taxed. If the QOF investment is kept for ten years or more, any gains from the QOF investment’s growth may not be taxed. This means that investors can earn big tax-free growth on their investments over the long term. This is a strong reason for investors to put their money into qualified opportunity funds for the long term (QOFs).

3. Diversification And Portfolio Optimization

QOFs may offer a chance to diversify and improve a business in different ways. Investors can diversify their portfolios beyond the normal asset classes, such as stocks and bonds, by putting money into real estate or running businesses in Opportunity Zones. This can help spread out the danger of investments and make the portfolio as a whole do better.

4. Capital Gains Reduction

In addition to putting off paying taxes, investments in qualified opportunity funds (QOF) that are kept for at least 5 years get a 10% step-up based on the original gain that was put off. If the QOF assets are kept for at least 7 years, the step-up in basis goes up to 15% of the original deferred gain. This means that buyers can reduce the amount of taxable capital gains, which saves them money on taxes.

5. Social Impact And Economic Development

Investing in qualified opportunity funds (QOFs) can benefit society because it can help underserved communities grow their economies, leading to more job opportunities. The main purposes of quality-of-life funds are to revitalize run-down places, create new jobs, and help the economy grow. Therefore, investors can help improve their communities social and economic well-being by putting their money into qualified opportunity funds (QOFs). This way, their investments match up with their values and goals.

6. Risk Mitigation

QOFs carry some risk, just like any other type of investment, but they can also give rewards that reduce risk. When they invest in a qualified opportunity fund, investors can lower their general risk by spreading their money across a wide range of assets and places. (QOF). Also, qualified opportunity funds must follow the rules and limits for investments implemented by the Opportunity Zones program. These rules and guidelines may give buyers more ways to stay safe.

7. Access Underserved Markets

Access to markets that traditional investors have yet to pay much attention to is available in Opportunity Zones, where the economy is bad and where standard investors may not have been interested in the past. Investing in QOFs can give you business opportunities in these underdeveloped areas, making a lot of money in places with untapped growth and development potential. Putting your money into QOFs is also an excellent way to spread your investments.

8. Flexibility In Investment

Flexibility, Qualified opportunity funds can invest in a wide range of asset types, such as real estate, businesses already running, and projects that build or improve infrastructure. Because of this, investors can choose an investment plan that fits their level of comfort with risk, their financial goals, and their level of investment skill. It also allows investors to invest in a wide range of industries and sectors, depending on their tastes and views of the market.

9. Estate Planning and Wealth Transfer

Using QOFs as part of your estate planning and plans to pass on your money could be helpful. People who put money into qualified opportunity funds (QOFs) can give their investments to their heirs on a stepped-up basis. This could help their heirs pay as little as possible in capital gains tax when they buy assets. This could be a handy estate planning tool for people who want to minimize the economic effect of passing on their wealth to the next generation while still keeping their wealth.

10. Potential Of Competitive Returns

Even though quality-of-life funds are usually created with a focus on helping people, one of their main goals is to give owners good returns. In the long run, qualified opportunity funds (QOFs) that invest in real estate and companies in opportunity zones can make good returns for their level of risk. As a result, these kinds of investments might qualify for tax breaks and other types of programs to help the economy grow.

Conclusion

The arrangement is clear to you now. Knowledgeable investors may want to consider Qualified Opportunity Fund (QOF) investing. Investing in “opportunity zones” can improve the local economy and possibly defer or reduce your tax liability simultaneously. QOFs are a unique and appealing way to invest because they offer the diversification, tax breaks for long-term capital gains, and the chance to make a positive social impact. Educate yourself by researching, thinking through the outcomes, and talking to professionals.

So, why wait? You may want to investigate the potential of QOFs if you want to enhance your investment strategy and make a major difference in underprivileged communities.